Interesting for sure, but he did display some iffy defensive moments at LB for Lecce. Last six months he's been playing LW and even RW in their last game. He came on to get his full international debut, against Switzerland, Thursday evening, and even scored after 47 secs with his first touch. Got a nice physical package but it's a little difficult judging him as a LB at the moment

-

The Fighting Cock is a forum for fans of Tottenham Hotspur Football Club. Here you can discuss Spurs latest matches, our squad, tactics and any transfer news surrounding the club. Registration gives you access to all our forums (including 'Off Topic' discussion) and removes most of the adverts (you can remove them all via an account upgrade). You're here now, you might as well...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Transfers January Transfer Thread 24/25

- Thread starter Billy Bob mate

- Start date

Latest Spurs videos from Sky Sports

. He came on to get his full international debut, against Switzerland, Thursday evening, and even scored after 47 secs with his first touch. Got a nice physical package but it's a little difficult judging him as a LB at the moment

That's pretty crazy money.

I still think Locko was the one we wanted and he got injured.

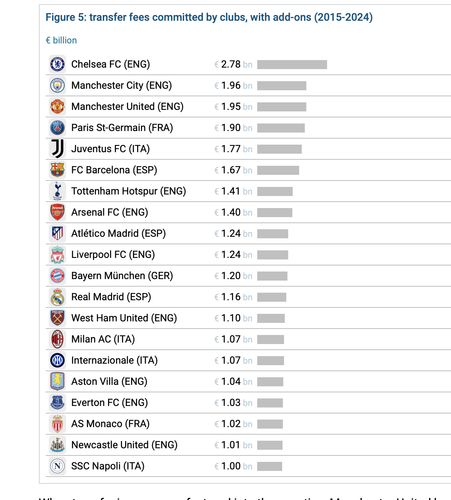

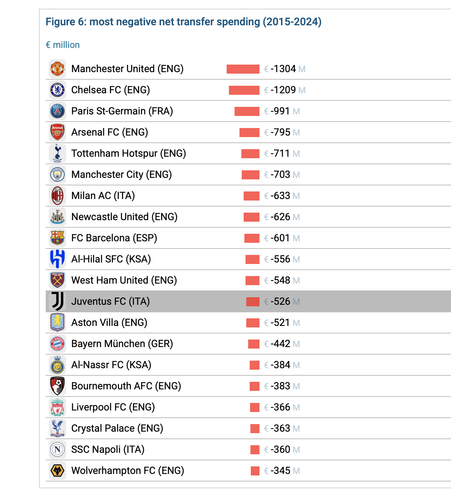

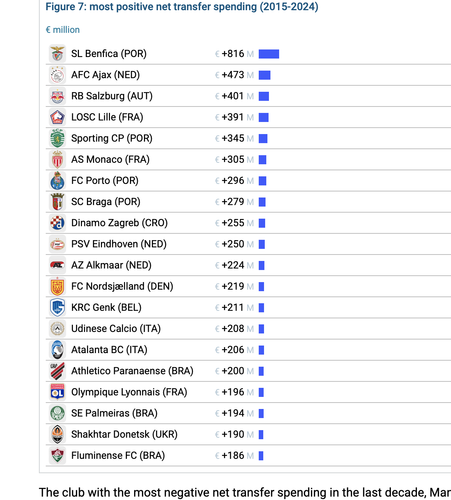

Global economic analysis of the transfer market (2015-2024) - CIES Football Observatory

This report analyses the transfer fee investments made by clubs on a global scale over the last decade. The first chapter reveals the evolution (...)

Starting to look like not going for Gyokeres was a mistake. The guy cannot stop scoring. Got a terrible feeling Woolwich will go for him as the crowning glory of their project next summer.

They could've gone for him this year if they wanted to. Reality is that Havertz is doing well and I'd be surprised if they're in for another striker.Starting to look like not going for Gyokeres was a mistake. The guy cannot stop scoring. Got a terrible feeling Woolwich will go for him as the crowning glory of their project next summer.

Starting to look like not going for Gyokeres was a mistake. The guy cannot stop scoring. Got a terrible feeling Woolwich will go for him as the crowning glory of their project next summer.

Did you watch the Sweden game?

Starting to look like not going for Gyokeres was a mistake. The guy cannot stop scoring. Got a terrible feeling Woolwich will go for him as the crowning glory of their project next summer.

In the Portuguese league...

Surely anyone that’s willingly spending time in this thread in September is a masochist.

Sporting Lisbon star Viktor Gyokeres admits his €100million (£84m) release clause likely discouraged the likes of Woolwich from signing him this summer.

The Sweden international enjoyed a sublime 2023-24 season in the Portuguese capital following his move from Coventry City, scoring 43 goals and laying on 15 assists in 50 appearances.

He has continued that magnificent form this season with seven goals in the first four games of the new Portuguese campaign.

Gyokeres was among the forward options considered at Woolwich this summer alongside Alaxander Isak and Benjamin Sesko with Raheem Sterling eventually arriving on loan from Chelsea on transfer deadline day.

Chelsea have also been credited with interest in the forward, submitting an offer worth £73m including bonuses which was rejected by Sporting in January.

He admitted his huge release clause was probably ‘too much’ and while he is happy at Sporting, suggested he will consider a move in the future.

The Sweden international enjoyed a sublime 2023-24 season in the Portuguese capital following his move from Coventry City, scoring 43 goals and laying on 15 assists in 50 appearances.

He has continued that magnificent form this season with seven goals in the first four games of the new Portuguese campaign.

Gyokeres was among the forward options considered at Woolwich this summer alongside Alaxander Isak and Benjamin Sesko with Raheem Sterling eventually arriving on loan from Chelsea on transfer deadline day.

Chelsea have also been credited with interest in the forward, submitting an offer worth £73m including bonuses which was rejected by Sporting in January.

He admitted his huge release clause was probably ‘too much’ and while he is happy at Sporting, suggested he will consider a move in the future.

He’s still a good player and absolutely levels above shit like Jesus and that mentalist Richarlson. Might not get 25 goals but a solid reliable focal point

Starting to look like not going for Gyokeres was a mistake. The guy cannot stop scoring. Got a terrible feeling Woolwich will go for him as the crowning glory of their project next summer.

He's every bit the 'middle-aged', potential one-season-wonder risk as Solanke was... Except Solanke actually bagged his goals in the EPL last season (rather than a league outside the top 4) whilst Gykores costs 20m more,

The fact that Solanke had a knock in his first game doesn't change any of that.

Oooh 20M, we might have done a Leeds with such an outrageous feeHe's every bit the 'middle-aged', potential one-season-wonder risk as Solanke was... Except Solanke actually bagged his goals in the EPL last season (rather than a league outside the top 4) whilst Gykores costs 20m more,

The fact that Solanke had a knock in his first game doesn't change any of that.

Guokeres has already scored 7 - should have signed both or one plus Isak

A bit bored during the International Break so having a look at our Accounts and likely impact of recent signings and deadwood removal, and what that means for transfer budget for the next couple of windows. Disclaimer: I am not an accountant, but I do have some basic grounding in accounting principles.

My conclusions:

The last 3 financial years reported (2020/21, 21/22 and 22/23) showed before-tax losses of -80.2, -50.1 and -86.8M, for an average of -72.4M. Apparently about 70M per year is spent on "infrastructure, training facilities and youth development" which is exempted from FFP, so adjusting for that our numbers excluding infrastructure are around -10M, +20M and -17M for 20/21, 21/22 and 22/23 respectively. That's an average earnings-before-infrastructure-and-tax of around -2M per year.

Going forwards, I assume our strategy is to keep that number at around zero.

I pulled transfer fee data from transfermarkt, and applied sensible amortisation to that, in order to estimate the impact of transfers on profit/loss. To match Annual Report figures I had to add in around 15M per year of "other" costs to account for agents fees, legals etc. The results compare pretty well, with differences here and there probably due to timing of transfers either side of the June 30 cut-off:

Rolling that forward and assuming no additional transfers in or out (other than in-progress outgoings like PEH, Gil, etc), and adding in wages (based on fbref, with manager wage and payout estimates from various sources added in):

Note that 23/24 amortisation less sales includes Harry Kane sale, while 24/25 includes sales of Skipp, Hojbjerg, Lo Celso, Royal, etc. In the Wages are, the drop in 23/24 is mainly the drop Postecoglou vs Conte, while 24/25 benefits from removal of Ndombele, Perisic, etc, and 25/26 further removes Werner.

Inflation should have a positive impact on matchday sales, TV earnings etc, although will be offset by increased costs. I'm going to assume the result is around 10M per year growth in net profit

The other big impact on profitability is European qualification. Taking into account prizemoney, matchday sales and TV, it's probably around 70M for 2022/23, and will be zero for the financial year just past (2023/24). I'm going to assume we net around 15M from Europa League this season, and return to Champions League the following season.

If there are no other impacts on revenue or costs, then earnings-before-infrastructure-and-tax would be expected to be around:

Remember that's with no addition transfers and no wage increases. The profits from 24/25 onwards can be used towards further squad strengthening, but are only likely to be spent if we have qualified for CL in the following season.

Going forwards, I assume our strategy is to keep that number at around zero.

I pulled transfer fee data from transfermarkt, and applied sensible amortisation to that, in order to estimate the impact of transfers on profit/loss. To match Annual Report figures I had to add in around 15M per year of "other" costs to account for agents fees, legals etc. The results compare pretty well, with differences here and there probably due to timing of transfers either side of the June 30 cut-off:

| Financial Year | Calculated Net Amortisation less Sales | Annual Report |

| 2017/18 | -9M | -5M |

| 2018/19 | 43M | 35M |

| 2019/20 | 53M | 58M |

| 2020/21 | 64M | 64M |

| 2021/22 | 60M | 61M |

| 2022/23 | 112M | 112M |

Rolling that forward and assuming no additional transfers in or out (other than in-progress outgoings like PEH, Gil, etc), and adding in wages (based on fbref, with manager wage and payout estimates from various sources added in):

| Financial Year | Net Amortisation less Sales | Wages | Total |

| 2022/23 | 112 | 139 | 251 |

| 2023/24 Estimate | 39 | 127 | 167 |

| 2024/25 Forecast | 69 | 103 | 171 |

| 2025/26 Forecast | 125 | 96 | 220 |

| 2026/27 Forecast | 120 | 96 | 215 |

Note that 23/24 amortisation less sales includes Harry Kane sale, while 24/25 includes sales of Skipp, Hojbjerg, Lo Celso, Royal, etc. In the Wages are, the drop in 23/24 is mainly the drop Postecoglou vs Conte, while 24/25 benefits from removal of Ndombele, Perisic, etc, and 25/26 further removes Werner.

Inflation should have a positive impact on matchday sales, TV earnings etc, although will be offset by increased costs. I'm going to assume the result is around 10M per year growth in net profit

The other big impact on profitability is European qualification. Taking into account prizemoney, matchday sales and TV, it's probably around 70M for 2022/23, and will be zero for the financial year just past (2023/24). I'm going to assume we net around 15M from Europa League this season, and return to Champions League the following season.

If there are no other impacts on revenue or costs, then earnings-before-infrastructure-and-tax would be expected to be around:

| Financial Year | Europe Earnings | Squad Costs | Inflation-related net increase in profit vs 2022/23 | Earnings Before Infrastructure and Tax |

| 2022/23 | 70 | 251 | - | -16.8 |

| 2023/24 Estimate | 0 | 167 | 10 | +7 |

| 2024/25 Forecast | 15 | 171 | 20 | +28 |

| 2025/26 Forecast | 60 | 220 | 30 | +34 |

| 2026/27 Forecast | 60 | 215 | 40 | +49 |

Remember that's with no addition transfers and no wage increases. The profits from 24/25 onwards can be used towards further squad strengthening, but are only likely to be spent if we have qualified for CL in the following season.

My conclusions:

- Spending in recent transfer windows has been pretty much in line with strategy of net profit/loss (excluding infrastructure) close to zero. We haven't "pushed the boat out" but nor are we particularly "keeping our powder dry" or "building a war-chest", despite what some might think.

- Recent deadwood removal was particularly necessary given lack of CL for two seasons in a row.

- Future spending depends heavily on CL qualification:

- If CL chances looking promising come January then we can probably afford one more 40-50M signing in January to help get it over the line

- If we don't qualify for CL then it will be a pretty lean window next summer in the absence of additional funding

- If we do qualify for CL next season then we can continue recent trend of ~100M net transfers per year and probably also start expanding our wage structure.

I don’t think this takes into account staged / staggered payments of transfers vs cash flowA bit bored during the International Break so having a look at our Accounts and likely impact of recent signings and deadwood removal, and what that means for transfer budget for the next couple of windows. Disclaimer: I am not an accountant, but I do have some basic grounding in accounting principles.

The last 3 financial years reported (2020/21, 21/22 and 22/23) showed before-tax losses of -80.2, -50.1 and -86.8M, for an average of -72.4M. Apparently about 70M per year is spent on "infrastructure, training facilities and youth development" which is exempted from FFP, so adjusting for that our numbers excluding infrastructure are around -10M, +20M and -17M for 20/21, 21/22 and 22/23 respectively. That's an average earnings-before-infrastructure-and-tax of around -2M per year.

Going forwards, I assume our strategy is to keep that number at around zero.

I pulled transfer fee data from transfermarkt, and applied sensible amortisation to that, in order to estimate the impact of transfers on profit/loss. To match Annual Report figures I had to add in around 15M per year of "other" costs to account for agents fees, legals etc. The results compare pretty well, with differences here and there probably due to timing of transfers either side of the June 30 cut-off:

Financial Year Calculated Net Amortisation less Sales Annual Report 2017/18 -9M -5M 2018/19 43M 35M 2019/20 53M 58M 2020/21 64M 64M 2021/22 60M 61M 2022/23 112M 112M

Rolling that forward and assuming no additional transfers in or out (other than in-progress outgoings like PEH, Gil, etc), and adding in wages (based on fbref, with manager wage and payout estimates from various sources added in):

Financial Year Net Amortisation less Sales Wages Total 2022/23 112 139 251 2023/24 Estimate 39 127 167 2024/25 Forecast 69 103 171 2025/26 Forecast 125 96 220 2026/27 Forecast 120 96 215

Note that 23/24 amortisation less sales includes Harry Kane sale, while 24/25 includes sales of Skipp, Hojbjerg, Lo Celso, Royal, etc. In the Wages are, the drop in 23/24 is mainly the drop Postecoglou vs Conte, while 24/25 benefits from removal of Ndombele, Perisic, etc, and 25/26 further removes Werner.

Inflation should have a positive impact on matchday sales, TV earnings etc, although will be offset by increased costs. I'm going to assume the result is around 10M per year growth in net profit

The other big impact on profitability is European qualification. Taking into account prizemoney, matchday sales and TV, it's probably around 70M for 2022/23, and will be zero for the financial year just past (2023/24). I'm going to assume we net around 15M from Europa League this season, and return to Champions League the following season.

If there are no other impacts on revenue or costs, then earnings-before-infrastructure-and-tax would be expected to be around:

Financial Year Europe Earnings Squad Costs Inflation-related net increase in profit vs 2022/23 Earnings Before

Infrastructure and Tax2022/23 - 2023/24 Estimate 10 2024/25 Forecast 20 2025/26 Forecast 30 2026/27 Forecast 40

Remember that's with no addition transfers and no wage increases. The profits from 24/25 onwards can be used towards further squad strengthening, but are only likely to be spent if we have qualified for CL in the following season.

My conclusions:

- Spending in recent transfer windows has been pretty much in line with strategy of net profit/loss (excluding infrastructure) close to zero. We haven't "pushed the boat out" but nor are we particularly "keeping our powder dry" or "building a war-chest", despite what some might think.

- Recent deadwood removal was particularly necessary given lack of CL for two seasons in a row.

- Future spending depends heavily on CL qualification:

- If CL chances looking promising come January then we can probably afford one more 40-50M signing in January to help get it over the line

- If we don't qualify for CL then it will be a pretty lean window next summer in the absence of additional funding

- If we do qualify for CL next season then we can continue recent trend of ~100M net transfers per year and probably also start expanding our wage structure.

If we are continuing with talent acquisitions in January, I think we should be looking at Bazoumana Toure from Hammarby. Left winger, a position we will need to strengthen soon. He's really good now, and will only get better.

View: https://x.com/RisingStarXI/status/1832750912655315410?s=19

View: https://x.com/RisingStarXI/status/1832750912655315410?s=19

If we are continuing with talent acquisitions in January, I think we should be looking at Bazoumana Toure from Hammarby. Left winger, a position we will need to strengthen soon. He's really good now, and will only get better.

View: https://x.com/RisingStarXI/status/1832750912655315410?s=19

I presume he can do more than just accelerate?

I thought we were pretty flush with left wingers already, Son, Odobert, Yang, Moore...

This is the one , isn’t it ?

Exciting times

Exciting times

What more do you want from a player mate?