You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

-

The Fighting Cock is a forum for fans of Tottenham Hotspur Football Club. Here you can discuss Spurs latest matches, our squad, tactics and any transfer news surrounding the club. Registration gives you access to all our forums (including 'Off Topic' discussion) and removes most of the adverts (you can remove them all via an account upgrade). You're here now, you might as well...

Latest Spurs videos from Sky Sports

Would not surprise me to see a few clubs go under due to coronavirus.

Tottenham have three of top five profits ever recorded

Tottenham have three of the top five profits ever recorded by a Premier League club, Football Insider analysis of accounts showswww.footballinsider247.com

Analysis by Football Insider has showed that Spurs’ pre-tax profit for the 2018-19 season was the fourth highest ever recorded by a Premier League club.

It is behind only Leicester City (£92m) in 2016-17, Liverpool (£125m) in 2017-18 after they sold Philippe Coutinho and Tottenham themselves, who hold the record with their jawdropping £139m profit in 2017-18.

Spurs are also in fifth place among Premier League clubs with the £80m profit they made in 2013-14.

Chairman Daniel Levy has warned that the club is “facing uncertain times” amid the coronavirus pandemic and must also service a net debt of £534m to repay banks for loans to build their magnificent new stadium.

Highest pre tax profits recorded in English football:

1: Tottenham £139m

2: Liverpool £125m

3 Leicester £92m

4: Tottenham £82.3m

5: Tottenham £80m

I know people say we have greedy owners but our accounts could see us be fine where others will face genuine uncertainty right now.

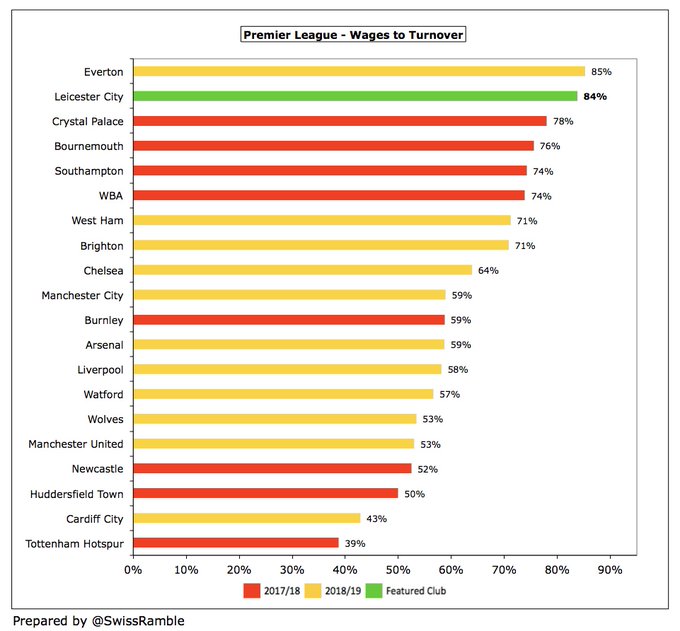

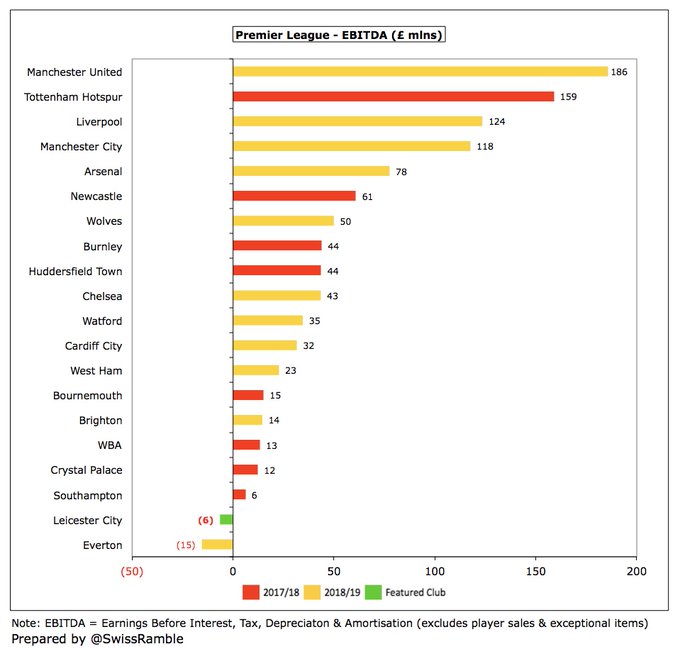

Those clubs with huge wage to revenue exposure would be the ones I'd expect to feel the heat first:Would not surprise me to see a few clubs go under due to coronavirus.

Cross the above with shite EBITA numbers and these clubs are walking a tightrope.

Source?

Exclusive: Tottenham borrow £175m through government scheme

Club have taken out a low interest loan from the Bank of England to help offset estimated £200m in lost revenue during pandemic

The north London club met a set of strict criteria to qualify for the government’s Covid Corporate Financing Facility (CCFF), which will provide an unsecured loan — repayable in full at a rate of 0.5 per cent — to give them financial flexibility and additional working capital during the crisis. Spurs estimate they may stand to lose more than £200 million of revenue in the period from the start of lockdown to June 2021.

It is only available to firms with an investment grade credit rating — the highest level of credit rating, which reflects at least an adequate capacity to meet financial commitments — and who make a material contribution to the UK economy.

Manchester United are thought to be the only other Premier League club who would be eligible for the CCFF scheme by virtue of having a formal credit rating from an agency. Spurs satisfied the CCFF stipulations after they had £525 million of stadium debt refinanced last year. Bank of America Merrill Lynch and HSBC had helped

I wouldn't read into this too much. It's basically free money that Levy is able to borrow because of the club's credit rating. This is a no brainer.

£175m loan for an apparent interest fee of £1.75m is well worth it for a little protection just in case. As you said a no brainer if the interest rates I’ve read about are accurate, it takes advantage of our well balanced books.

Last edited:

Just had the strangest conversation at the supermarket checkout with a Mexican-Spanish neighbour, she's about 75 going on 80. It was made more surreal by us both being muffled by our respective face masks.

María Jesús: Hi Bill, everything OK?

Me: Yes thanks Mª Jesús, how are you and your family?

Mª Jesús: Fine thanks. By the way, congratulations! (I assume this was a reference to my Spanish nationality finally coming through, I'd mentioned it to her husband last week) And great to see Tottenham getting that line of credit, it sounds like they needed it!

Me (confused, I had no idea whatsoever she knew I liked football, much less supported Spurs): Sorry?

Mª Jesús: I read that Spurs had been granted an important line of credit. That must be a big relief!

Me (still confused): Tottenham?

Mª Jesús (starting to look at me like I was a bit daft): Yes, Tottenham have a lot of debt don't they? So this new credit should smooth things over.

Me (pulling myself together): Aaaah yes, well yes we have just built a huge new stadium so I suppose it will help!

Mª Jesús: That's right - it cost a billion euros, right? Well, nice to see you, give my love to your wife! (exits stage left with a jaunty wave)

María Jesús: Hi Bill, everything OK?

Me: Yes thanks Mª Jesús, how are you and your family?

Mª Jesús: Fine thanks. By the way, congratulations! (I assume this was a reference to my Spanish nationality finally coming through, I'd mentioned it to her husband last week) And great to see Tottenham getting that line of credit, it sounds like they needed it!

Me (confused, I had no idea whatsoever she knew I liked football, much less supported Spurs): Sorry?

Mª Jesús: I read that Spurs had been granted an important line of credit. That must be a big relief!

Me (still confused): Tottenham?

Mª Jesús (starting to look at me like I was a bit daft): Yes, Tottenham have a lot of debt don't they? So this new credit should smooth things over.

Me (pulling myself together): Aaaah yes, well yes we have just built a huge new stadium so I suppose it will help!

Mª Jesús: That's right - it cost a billion euros, right? Well, nice to see you, give my love to your wife! (exits stage left with a jaunty wave)

I'm not so sure. The idea of well structured debt is often used to justify what is an overleveraged financial situation. Debt is debt, ok we have had a period of historically low interest rates, but that is not guaranteed for the next ten years now.

Covid was an outlier, as was Brexit at some point, but in the event of a no-deal Brexit, sterling will get hammered in financial markets, and interest rates will shoot up to protect the currency. That makes being in a highly indebted situation a very different scenario.

I also think fans are in wonderland if they think we are not going to have one hell of a recession ahead. If you lose your job, or fear losing it in the next few months, you won't renew your season ticket. So the idea we will continue to make however millions per home game is questionable.

I know a lot of spurs ST holders in your normal Spurs like jobs - running infrastructure companies, or coffee sellers for offices - they think revenues will be down at least 50percent for a year, maybe longer.

The bonds carry interest at a fixed rate for the next circa 23 years (average at 2.66%) - that's why we switched out of bank loans to get a fixed interest rate. Cost circa £16m pa interest, repayment at maturity.

And the £175m coronavirus loan carries an interest rate of 0.5% so if we use it, it costs less than £1m.

So Spurs are well set up financially.

Revenues come from 3 main sources :

Matchday revenues - clearly this may well be affected, with reduced crowds allowed back in the stadium initially. Spurs have a significant waiting list for tickets and whilst there maybe a high unemployment rate of (say) 15%, Spurs problem will be how to allocate seats if there is a reduced capacity initially - it will have little problem in selling seats. Only question is when stadiums will be allowed to sell 100% of seats - and that will affect all PL clubs. The other point to make is Spurs are much less dependent upon match day revenues than they used to be. The biggest issue will be loss of european match revenues and prize money.

TV revenues - Unaffected by covid until the end of the tv deals.

Commercial revenues - Sponsorship deal income was growing significantly pre-covid. More likely to plateau than fall. Spurs had started a significant exhibition and conference business, but that may be hit in the next 12 months, but its revenues we never had at WHL, and not in lsast years accounts either.

There is absolutely no way at all that revenues will be down 50% on previous years - with additional revenue streams in the new stadium (versus WHL), its probable that revenue growth will not meet pre-covid expectations, and whilst we will get some benefit from these additional revenue streams that might just replace other revenue losses leaving no change on previous years revenues. If we do not get european football that will result in revenue loss - but that's nothing to do with covid.

With the lowest wages/revenues ratio in PL Spurs will be far better placed than most clubs to ride out covid.

However don't expect the same £100m + transfer pot this summer that happened last summer - and other than Mancity (who avoid any ffp rules and owners regard the club as cleaning the country's image so money is no object) other clubs ae likely to be similarly cautious in spending big money.

Financial results, year end 30 June 2019 | Tottenham Hotspur

Financial Highlights

www.tottenhamhotspur.com

Revenue for the year ended 30 June 2019 was £460.7m (2018: £380.7m).

Premier League gate receipts were £34.3m (2018: £42.6m). Home matches in the 2018/19 season were played at Wembley Stadium for 14 of the 19 home Premier League games, and at Tottenham Hotspur Stadium (“THS”) for the remaining five games.

The Club reached the Final of the UEFA Champions League (2018: Round of 16 of UEFA Champions League) resulting in gate receipts and prize money of £108.4m (2018: £62.2m). This represents the 13th time in the last 14 seasons that the Club has played in Europe.

Revenue from the domestic cup competitions earned the Club £3.1m (2018: £4.4m).

Television and media revenues increased to £149.9m (2018: £147.6m), due to an additional live televised game and overseas media revenues, whilst the Club finished 4th in the Premier League (2018: 3rd).

Sponsorship and corporate hospitality revenue was £120.3m (2018: £93.4m) and merchandising revenue was £20.6m (2018: £16.0m). Other revenue contributed £24.1m (2018: £14.5m).

Profit from operations, excluding football trading and before depreciation was £172.7m (2018: £162.5m). Profit for the year after all charges including interest and tax was £68.6m (2018: £113.0m).

The opening of THS in April 2019 has seen a significant investment in tangible assets totalling £1.4bn (2018: £1bn) – facilities which include the Training Centre, the new Players’ Lodge, Percy House, (home of the Tottenham Hotspur Foundation), Lilywhite House (Club offices), new retail warehouse, new Paxton House Ticket Office and the Tottenham Experience.

The total cost of intangible assets was £332m (2018: £327m) and subsequent to the year end a further £184m has been spent on player registrations.

These investments have been financed by profits made by the Club, advanced sponsorship monies and bank finance, principally from Bank of America Merrill Lynch International, Goldman Sachs Bank USA and HSBC Bank plc. At 30 June 2019, the Club had net debt of £534m (2018: £360m).

Subsequent to the year end, our total debt of £637m was converted in September 2019 into a mix of long-term maturities with an average life of 23 years.

Running the Club within Financial Fair Play regulations, whilst servicing debt and continuing to invest in both tangible and intangible assets continues to be a key focus for the Board.

Chairman, Daniel Levy:

“We are painfully aware that it seems wholly inappropriate to be giving any attention to the prior year’s financial results at a time when so many individuals and businesses face worrying and difficult times. We are however legally required to announce these by 31 March 2020.

“We are all facing uncertain times both at work and in our personal lives. I have spent nearly 20 years growing this Club and there have been many hurdles along the way – none of this magnitude – the COVID-19 pandemic is the most serious of them all.

“You will have noticed that we have, as a necessity, ceased all fan-facing operations. With such uncertainty we shall all need to work together to ensure the impact of this crisis does not undermine the future stability of the Club. This will include working with the wider football industry and its stakeholders to seek to restore the season – but only when it is safe and practical to do so.

Our priority is the health and wellbeing of our staff, players, partners, supporters and their families.

“We shall look to come out of this stronger and more resilient than ever. Our hope is that the virus peaks over the coming weeks and that we have a summer to enjoy.

“Please look after yourselves and stay safe and healthy. This is more important than football.”

European Leagues' chief hails Spurs' model as the one to follow amid crisis - The Spurs Web - Tottenham Hotspur Football News

With clubs around Europe, including footballing giants such as Barcelona said to have been financially impacted due to the impact of the coronavirus pandemic (Sports...

With clubs around Europe, including footballing giants such as Barcelona said to have been financially impacted due to the impact of the coronavirus pandemic (Sports Illustrated), questions have been raised about the sustainability of the previous business models of many clubs (The Guardian).

With match-day, commercial and broadcast revenue all receiving a massive blow, many teams across Europe have been forced to ask their players to take wage cuts while Barcelona are said to be prepared to listen to offers for some of their big signings (The Sun).

Although Tottenham have their own problems due to the considerable debt that the club owes following the construction of the new stadium, one saving grace for the lilywhites during this crisis has been their relatively small wage bill compared to other clubs of a similar size.

Tottenham’s wage bill is considerably lower than the other members of the Premier League ‘big six’, as well as Everton (Global Sports Salaries Survey).

In fact, as a proportion of the turnover, Spurs pay the least in wages in the whole of the Premier League, with a wage to turnover ratio of just 38 per cent (The Sun).

Jacco Swart, the managing director of the European League in charge of 36 leagues and over 950 clubs across Europe, believes that Tottenham are the model to follow for the other clubs across the continent following the coronavirus crisis.

Swart told Italian daily Gazzetta dello Sport (as relayed by Inside Football): “The numbers and strategies of Spurs are an encouraging sign for the new normal in football.”

For all the criticism that ENIC and Daniel Levy have received over the years for not paying more in wages, it looks like their decision to run the club sustainably has now turned out to be our saving grace. While no one could have obviously foreseen the effects of the pandemic, paying around 70 per cent of a club’s revenue as wages (as some in the Premier League do) is an extremely risky proposition that has ended quite badly for clubs like Leeds United and Aston Villa in the past.

It is not as if Tottenham haven’t increased the wages of their top players over the years. Baring the likes of Man City, Barcelona, Manchester United and Real Madrid, we still pay competitive salaries in comparison to the other big sides in Europe. However, Levy has ensured that our wage to turnover ratio has still remained relatively low.

Spurs now ahead of both Chelsea (just) and Woolwich on revenue - really opening Spurs up to competing for players against those clubs.

Into the top 4 on revenue for the first time - in decades or possibly ever ?

Impossible of course to forecast the future financial state of Spurs or any other club atm.

My boy at the club says we could lose almost 100m if the season gets wiped out, not turnover but bottom line all our agreements are conditional on playing a certain number of games, we will breach many of them if the season is made void. Discussions with sponsors are positive but a lot of those companies are also in severe financial trouble so not paying us would obviously help them. We can survive a 100m hit we are financially very well placed right now, but there will be no significant cash on hand even if there is a transfer window. That's not Levy or ENIC that's every club everywhere.

That said he told me that speaking with other clubs the feeling is that upto half the professional clubs in the UK could be at risk of folding without private investment or loans ... there will be several clubs, big clubs as well, who might be looking to sell players just to stay afloat ... if we see opportunities then transfer funds can be found, allegedly we're already looking.

The EPL is in a much better position than a lot of the smaller European leagues, several of them are already in real trouble being far more reliant on gate receipts than the big leagues are. The FA and other associations who rely more on massive gate receipts than the clubs, are also hurting badly. They will not now see any income this year from the Euros either which many were banking on.

If Covid hangs around for a year football will be spun on it's head, however it will no doubt return with a vengeance and perversely the TV companies are the ones who are making money from Covid especially those with paid streaming, because of that there is talk of some fairly massive advance TV payments to clubs in return for an extended TV contract. All very much rumour and very fluid, like everybody else the club is pretty clueless although quietly he said nobody believes there will be any football until next season, and who knows when that will start.

He reckons Woolwich are really hurting, already making no money this is crushing them ... their owner is also seeing massive sporting losses in the US so no help likely from there.

That said he told me that speaking with other clubs the feeling is that upto half the professional clubs in the UK could be at risk of folding without private investment or loans ... there will be several clubs, big clubs as well, who might be looking to sell players just to stay afloat ... if we see opportunities then transfer funds can be found, allegedly we're already looking.

The EPL is in a much better position than a lot of the smaller European leagues, several of them are already in real trouble being far more reliant on gate receipts than the big leagues are. The FA and other associations who rely more on massive gate receipts than the clubs, are also hurting badly. They will not now see any income this year from the Euros either which many were banking on.

If Covid hangs around for a year football will be spun on it's head, however it will no doubt return with a vengeance and perversely the TV companies are the ones who are making money from Covid especially those with paid streaming, because of that there is talk of some fairly massive advance TV payments to clubs in return for an extended TV contract. All very much rumour and very fluid, like everybody else the club is pretty clueless although quietly he said nobody believes there will be any football until next season, and who knows when that will start.

He reckons Woolwich are really hurting, already making no money this is crushing them ... their owner is also seeing massive sporting losses in the US so no help likely from there.

Last edited:

Probably a good thing that levy knows how to run a business at a time like this

only us and Man U are able to I think AAA credit rating.We are the only club to take advantage of this facility

Tottenham face staggering £852MILLION of loan repayments to cover cost of their new stadium

TOTTENHAM will have to fork out £852MILLION in loan repayments to cover the cost of their new stadium. According to their latest set of accounts, the North Londoners must pay back the staggering su…www.thesun.co.uk

The total repayment includes a whopping £215m in interest which puts the overall liability at just over £852m.

As well as using some of their own cash reserves, Spurs initially borrowed £637m from Goldman Sachs, Bank of America Merrill Lynch and HSBC to cover the stadium project.

But chairman Daniel Levy refinanced £525m of that debt into a long-term bond scheme last September.

Official documents show the average length of all remaining stadium related loans - some of which run until 2050 - is 23 years with an interest rate of 2.66 per cent APR.

Figures in the latest accounts for Tottenham Hotspur Stadium Ltd to 30 June 2019 show the club must pay back an average of £37m-a-year until 2042 to pay off the full amount.

However, the North Londoners have the option of making interest only payments for the first ten years of the arrangements.

To put the £37m figure into context, over the past five years prior to the most recent January transfer window Spurs have had a net transfer spend of approximately £21m-a-season.

But although the sums sound huge, the repayments will be more than manageable thanks to the huge increase in matchday revenue the new stadium has brought compared to old White Hart Lane.

Spurs average around £5m-revenue-per-home-game in the new ground meaning their matchday takings look set to well exceed £100m-a-year for the foreseeable future.

These numbers are more than DOUBLE the £45.3m matchday revenue the club bagged in 2017 - the last season at their old stadium.

And that is without taking into account other hosted events like the NFL and Anthony Joshua's postponed fight with Kubrat Pulev which also bring in extra cash.

However, as a result, the current sporting blackout brought on by Covid-19 is hitting Spurs hard as their business model relies heavily on such income.

Tottenham valued their impressive new home at £1.1billion in the latest accounts.

The Sun have got things wrong - they've confused the terms of the bank loans which are in the last annual accounts with the bonds which were taken out after the last year end..

£525m of the debt has been refinanced as bonds, with the bonds only being repayable on average in 23 years time.

The only amount of the bonds that has to be paid in the next 23 years is the annual interest of circa £14m pa,

In addition there is a £112m bank loan with a long term repayment date - interest rate I think is average of 2.66%. so amount payable annually is low at circa £3m pa.

Just had the strangest conversation at the supermarket checkout with a Mexican-Spanish neighbour, she's about 75 going on 80. It was made more surreal by us both being muffled by our respective face masks.

María Jesús: Hi Bill, everything OK?

Me: Yes thanks Mª Jesús, how are you and your family?

Mª Jesús: Fine thanks. By the way, congratulations! (I assume this was a reference to my Spanish nationality finally coming through, I'd mentioned it to her husband last week) And great to see Tottenham getting that line of credit, it sounds like they needed it!

Me (confused, I had no idea whatsoever she knew I liked football, much less supported Spurs): Sorry?

Mª Jesús: I read that Spurs had been granted an important line of credit. That must be a big relief!

Me (still confused): Tottenham?

Mª Jesús (starting to look at me like I was a bit daft): Yes, Tottenham have a lot of debt don't they? So this new credit should smooth things over.

Me (pulling myself together): Aaaah yes, well yes we have just built a huge new stadium so I suppose it will help!

Mª Jesús: That's right - it cost a billion euros, right? Well, nice to see you, give my love to your wife! (exits stage left with a jaunty wave)

She's now back speaking to her husband "I think that Bill's a closet gooner....I mentioned the spurs loan to him and he didn't have a fucking clue what I was talking about"

On top of that, inflation sitting well above the 0.5% rate for this facility means that it is gaining value just by Spurs having access to it. With inflation around 2%, that's a 1.5% margin every year...

That boy Daniel's done it again...

The stadium is going to be an albatross around the club's neck for many years now. It's a lot of money in terms of original outlay and now it is losing money like a widow in a casino.

I think the only resolution will be - either new owners, who pay off the debt, but that's unlikely as even our Russian and Saudi oligarch friends are feeling the pinch now.

Or we accept we have to play negative Mourinho-ball for the next five seasons to remain in the top six without any real investment into the squad.

The financials are going to be dire - Spurs had to take a Bank of England loan, and ultimately you have to demonstrate significant potential for financial distress for one of them.

Even with a resolution to Covid like a vaccine, the potential for the events side of the business are v limited as I think the days of paying £100 for a ticket to a boxing match are over for many people due to the financial crunch.

The financials actually leave us instantly in a better position with the stadium build and bond agreement, but only once the fans return to the stadium.

Total match receipts for our last season at WHL whereby the stadium was complete (2016) was £40.782m. Our estimated match day revenue in the new place is rumoured to be c£100m so instantly it’s £60m better off. For arguments sake let’s say we have to pay back £40m each season in loans and interest.... we are still instantly £20m better off regardless of loans and interest.

The issue is if we cannot obtain that matchday revenue during times where supporters can’t attend, can’t use the facilities, until they can it will be a burden but once that’s over, as long as we can hit the £100m mark most seasons it’s an instant positive regardless of costs incurred.

I speculate that the reason we took out a Bank of England loan is because it’s next to nothing in interest and us along with Man U I think were the only clubs who qualified for it due to our AAA credit ratings. In a time where we don’t know what’s around then corner the club probably looked at the risk/ reward and saw the BofE and their ridiculously low interest rates as a no brainier.

We owed £1.2bn, we’ve already paid off half of that prior to moving into the new stadium, our situation isn’t as bad as face value would seem. Check out Comlanies house website if you have an interest in digging into things more

TOTTENHAM HOTSPUR LIMITED filing history - Find and update company information - GOV.UK

TOTTENHAM HOTSPUR LIMITED - Free company information from Companies House including registered office address, filing history, accounts, annual return, officers, charges, business activity

If having a bunch of concerts and events in your stadium was all rainbows and sunshine, happiness and free cash, you don't think other clubs and arenas would be doing it?

They do.....as much as their facilities and demand allow

Literally the entire point of our dual purpose pitch is to allow us to hold as many events as we want without fucking the playing surface (see Wembley after NFL)

With our Net profit being down, the coronavirus hitting and us staring down the barrel of no champions league I can’t see how we will compete very well in the transfer market (when it re opens).

only way I can see us getting players in is if Levy completes a stadium sponsorship deal.

We posted the 4th highest pre-tax profit any English team ever has this week mate and we don’t spend our Champions League money like it’s a necessary and standard revenue stream. There will be less money coming in which ultimately will lead to less to spend, that’s inevitable but we are in extremely good shape compared to the majority of clubs, who may need to sell assets in order to survive instead of flourish now.

The boat we are in right now, most others are I wouldn’t sweat it.

Last edited: